In todays fast-paced financial landscape, automated trading systems have emerged as a revolutionary force, captivating both novice investors and seasoned traders alike. These sophisticated algorithms, designed to execute trades at lightning speed, remove many of the emotional nuances that often cloud human judgment.

Imagine a world where decisions are driven by data and precise calculations rather than impulsive fear or greed. Automated trading not only enhances efficiency but also provides unparalleled access to market opportunities—functions that can be particularly beneficial in volatile conditions.

From optimizing strategies in real-time to freeing up valuable time for traders, the advantages are numerous and compelling. As we delve deeper into the world of automated trading, we will explore the key benefits that make these systems an indispensable tool for modern investors striving for success.

Efficiency and Speed in Trade Execution

Automated trading systems revolutionize the landscape of finance by enhancing both efficiency and speed in trade execution, effectively minimizing the lag that human traders face. Imagine a scenario where a trading opportunity arises in mere milliseconds—traditional methods might flounder, encumbered by the limitations of human decision-making and reaction time.

With automated trading software, in contrast, systems analyze vast amounts of data, identify patterns, and execute trades within fractions of a second. This precision means that traders capture optimal price points that would otherwise slip through their fingers.

Not only do these systems operate around the clock, addressing market fluctuations instantaneously, but they also eliminate emotional biases that can derail a trading strategy. In this high-paced environment, efficiency and speed become not just advantages, but crucial elements for success in a fiercely competitive market.

Emotion-Free Trading: Eliminating Psychological Bias

Emotion-free trading is one of the most compelling advantages of utilizing automated trading systems. By design, these systems operate devoid of the emotional influences that can cloud human judgment—fear, greed, and uncertainty often lead traders to make impulsive decisions.

Imagine a trader who hesitates at the brink of a market downturn, allowing anxiety to dictate their moves, or one who, swept up in a markets euphoria, overextends their risk. Automated trading systems eliminate these pitfalls by adhering strictly to pre-set algorithms and strategies, executing trades based on data and predefined criteria, rather than fleeting emotions.

Consequently, this disciplined approach enhances overall performance and promotes consistency, allowing traders to stick to their strategies ruthlessly, unhindered by the turbulence of market sentiment. In this way, users not only safeguard their capital but also cultivate a systematic trading routine that transforms chaos into clarity.

User-Friendly Interfaces and Accessibility for Traders

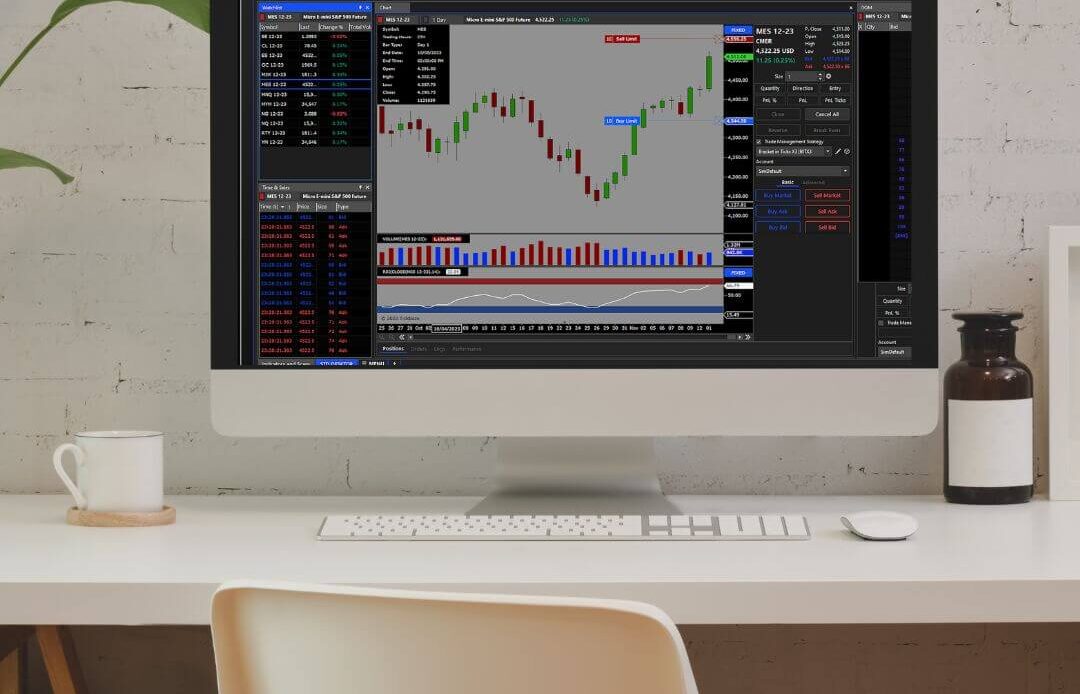

One of the standout advantages of automated trading systems is their commitment to user-friendly interfaces, which significantly enhance accessibility for traders of all skill levels. Imagine a dashboard that seamlessly integrates real-time data, customizable charts, and intuitive navigation—this is what a robust trading platform offers.

For novices, the clear, guided interaction minimizes the intimidation often associated with advanced trading strategies. Meanwhile, seasoned traders can delve into deeper analytical tools without feeling bogged down by complexity.

Furthermore, many platforms prioritize accessibility features, ensuring that those with disabilities can engage confidently with the system. By blending sophistication with simplicity, automated trading systems create an environment where traders can focus on strategy and execution rather than grappling with cumbersome technology.

Conclusion

In conclusion, the integration of automated trading systems into financial markets presents a multitude of advantages that can significantly enhance trading performance. By leveraging automated trading software, traders can execute strategies with precision and speed, reducing the emotional biases that often hamper decision-making.

The ability to analyze vast amounts of data in real-time allows for more informed trading decisions, ultimately promoting greater efficiency and consistency. Furthermore, the 24/7 capabilities of these systems enable participation in global markets outside of traditional hours, opening up additional opportunities for profit.

As technology continues to advance, adopting automated trading systems will likely become an essential strategy for both individual traders and institutional investors looking to maximize their potential in an increasingly complex market landscape.